Managing your personal finances can be overwhelming, especially when you’re juggling investments, budgets, and everyday expenses. Arlo Finance is a modern solution designed to simplify this process with precision and ease. Whether you’re a novice investor or a seasoned planner, Arlo Finance offers comprehensive features to help individuals take full control of their financial lives.

TL;DR Summary

Arlo Finance is an advanced personal finance tool designed to help you easily manage both budgets and investments. It offers real-time synchronized data, intuitive dashboards, automated reporting, and smart forecasting features. Whether you’re looking to cut costs or optimize your investment portfolio, Arlo Finance provides the capabilities to do both efficiently. With a user-friendly interface and top-notch security features, it’s a trustworthy companion for serious financial planning.

Understanding Arlo Finance

Arlo Finance is a cloud-based financial management platform that brings together investment tracking and budget management under one digital roof. Founded with the vision of simplifying personal financial controls, it leverages automation, data aggregation, and AI-driven insights to provide a comprehensive overview of your financial health.

This dual-feature approach helps users avoid the common pitfall of treating budget tracking and portfolio management as separate tasks. With Arlo Finance, they are seamlessly integrated, giving you a complete picture of what you own, what you spend, and how it all connects in real time.

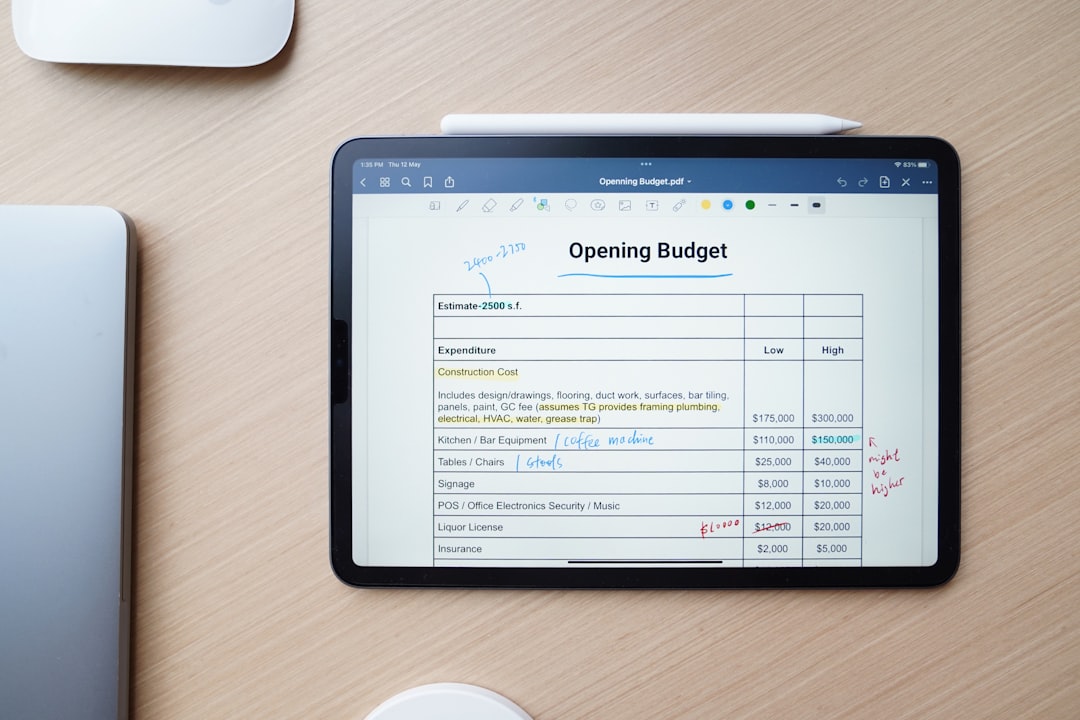

Key Features for Budget Management

Budgeting with Arlo Finance goes far beyond logging expenses. The platform incorporates several intelligent features that put you in control of your spending behavior:

- Automatic Expense Categorization: Sync your bank accounts and categorize every transaction in real-time, from grocery purchases to loan payments.

- Customizable Budget Goals: Set specific financial goals for monthly or yearly periods, and track your progress visually with color-coded sliders and graphs.

- Smart Forecasting: Based on your spending trends and income fluctuations, Arlo provides predictive forecasting to warn you of potential overspending or cash-flow issues ahead of time.

- Alerts and Notifications: Get real-time alerts when you exceed budget limits or when suspicious activity is detected across linked accounts.

The interface is designed to be user-friendly yet highly customizable, ideal for individuals and families alike who want meticulous control over their finances.

Investment Management Made Simple

Unlike traditional finance apps that only track spending, Arlo Finance takes investment management seriously. It supports all major investment account integrations, including brokerage accounts, retirement portfolios, crypto wallets, and even real estate tracking.

- Portfolio Aggregation: View all your investment accounts on a unified dashboard. Arlo supports assets from stocks, bonds, ETFs, cryptocurrencies, and mutual funds.

- Performance Analytics: Evaluate the performance of your holdings via metrics such as ROI, CAGR, and portfolio diversification ratios.

- Risk Assessment Tools: The platform offers simulations and Monte Carlo scenarios to help assess risks and potential returns before making new investments.

- Tax Reporting: Automatically prepares reports for capital gains, dividends, and interest income—helping simplify year-end tax filings.

Arlo also connects with popular investment platforms like Vanguard, Fidelity, Robinhood, Coinbase, and others, allowing real-time data synchronization without needing manual uploads or spreadsheets.

Security and Privacy

Given that Arlo Finance deals with highly sensitive financial information, its security infrastructure is built to meet advanced industry standards. The platform uses:

- 256-bit AES Encryption to secure all data in transit and at rest.

- Two-Factor Authentication (2FA): Required for all logins and new device authorizations.

- Secure API Integrations: Uses OAuth and Open Banking protocols to sync data without storing user credentials.

- Regular Security Audits: Arlo undergoes third-party security assessments quarterly to ensure data integrity.

This level of cybersecurity means you can manage your money with minimal risk, knowing that your information is protected by defenses on par with major commercial banks.

Arlo’s AI and Predictive Capabilities

What truly sets Arlo Finance apart is its use of artificial intelligence not just to record— but to advise.

Arlo’s AI engine analyzes spending habits, investment behaviors, and goal achievement levels to suggest tailored actions. You might receive prompts such as:

- “Consider reallocating 5% of your equity holdings in anticipation of market volatility.”

- “You’ve exceeded your entertainment budget by 23% this month. Would you like help realigning other categories?”

Over time, the more you use Arlo, the more intelligent its predictions become. This customized feedback loop doesn’t just help you stay on track—it helps you get ahead financially.

Integration and Compatibility

Arlo Finance works across all major platforms. The web application can be accessed via all modern browsers, while the mobile applications are available for both iOS and Android operating systems. Moreover, Arlo offers API integrations with:

- Banking institutions for real-time balance updates

- Investment platforms for portfolio tracking

- Tax software such as TurboTax and H&R Block

For power users, Arlo also allows CSV data exports, live API feeds, and webhook support for third-party tools or spreadsheets. This makes it adaptable enough for casual budgeters and financial analysts alike.

Plans and Pricing

Arlo Finance offers a tiered pricing model suited to a variety of user types:

- Free Plan: Basic budget tracking, one connected investment account, and limited forecasting tools.

- Premium Plan ($8.99/month): Unlimited account integration, advanced AI analysis, and full-feature reporting tools.

- Professional Plan ($19.99/month): Designed for financial advisors or enterprise users managing multiple portfolios.

All plans come with a 14-day trial so users can evaluate the tools before committing. The platform also offers discounts for annual subscriptions and student plans.

Who Should Use Arlo Finance?

Depending on your financial goals, Arlo Finance offers serious advantages for several user types:

- Young Professionals: Starting careers and learning how to invest or save.

- High-Net-Worth Individuals: Seeking to diversify investments and track asset performance.

- Families: Managing shared household budgets and long-term financial goals.

- Freelancers and Entrepreneurs: Looking for an all-in-one hub for budgeting, income reports, and tax management.

Whether you want to eliminate debt, save for a house, or retire early, Arlo provides the structure and insights needed to stay on target.

Final Thoughts

If you’re serious about taking control of both your spending and investments, Arlo Finance delivers a powerful, secure, and intuitive solution that adapts to your life. It’s rare to find a platform that handles detailed budgeting and robust investment tracking with equal capability, but Arlo strikes that balance effortlessly.

With transparent data, predictive insights, and cross-platform accessibility, this is more than just another finance app—it’s a personal financial command center.