Deploying artificial intelligence (AI) tools in the field of accounting is rapidly becoming a strategic move for firms and finance departments seeking to improve efficiency, accuracy, and insight. These tools can automate repetitive tasks, reduce human error, and reveal actionable analytics, but recognizing and maximizing their return on investment (ROI) requires thoughtful planning and execution. Whether you’re adopting an AI-driven bookkeeping platform or leveraging smart forecasting software, understanding ROI can be the key to deriving real value from your investment.

TL;DR

To get the most value from AI in accounting, it’s essential to establish clear goals before deployment, monitor performance using KPIs, and adapt continuously as your business and technology evolve. Accurately measuring ROI includes tracking cost savings, efficiency gains, and quality improvements. Choose solutions that integrate seamlessly with your existing systems, invest in staff training, and periodically reassess usage to ensure relevance and effectiveness. Maximize value by treating AI adoption as a strategic transformation, not a quick fix.

1. Define Clear Financial and Operational Objectives

Before deploying an AI tool, it is vital to define what success looks like in relation to your business goals. What are the specific outcomes you are expecting—reduced time spent on reconciliations, increased forecasting accuracy, faster reporting?

- Set quantitative goals – Examples include reducing monthly close time by 30%, automating 80% of manual data entries, or improving error detection by 25%.

- Align AI deployment with strategy – Ensure the AI solution ties directly into strategic initiatives such as compliance, cost-cutting, or competitive differentiation.

- Use baseline metrics – Document current performance KPIs to serve as a comparative point for future improvement.

2. Understand the Full Cost of Ownership

ROI is not simply about the purchase price. Consider the total cost of ownership (TCO), which includes:

- Licensing fees – Ongoing or one-time, depending on the vendor.

- Implementation costs – Setup, customization, and integration efforts may require significant time and IT resources.

- Training and onboarding – Teams will need to be trained on how to use the system efficiently.

- Maintenance and support – Calculate ongoing support or potential consulting services if needed long-term.

Understanding the full investment adds accuracy to ROI calculations and prevents surprises post-implementation.

3. Measure ROI Using Both Tangible and Intangible Metrics

To track ROI comprehensively, organizations must consider both tangible and intangible benefits of the AI tool.

Tangible Metrics:

- Time saved – Monitor changes in time spent on processes such as invoice processing, bank reconciliations, and reporting.

- Error reduction – Measure reductions in manual entry errors, tax filing mistakes, or discrepancies in financial statements.

- Cost efficiency – Track reduced labor costs, consultant fees, and compliance penalties.

Intangible Metrics:

- Employee satisfaction – Reduced workload and increased staff satisfaction can lead to better morale and retention.

- Improved decision-making – Faster access to reliable data can empower leadership with quicker, more accurate financial insights.

- Agility and scalability – The ability to handle more complex data sets or customer demands as your business grows.

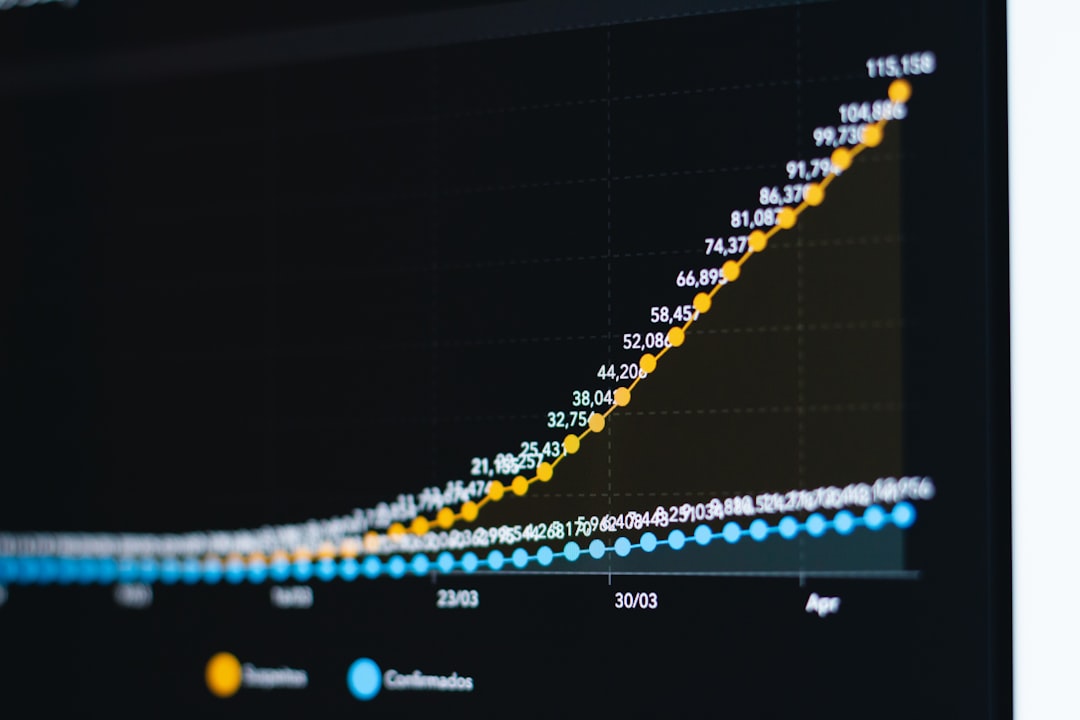

4. Build a Real-Time KPI Dashboard

Build or use integrated dashboards that allow you to continuously monitor KPIs related to performance, cost savings, and audit accuracy. Visualizing the impact of your AI tool in real time helps with:

- Identifying performance dips early and addressing bottlenecks before they grow.

- Communicating outcomes to stakeholders—including executive leadership and external auditors—using data visualization.

- Reinforcing adoption by showing how the tool enhances performance in everyday tasks.

Leading AI vendors in accounting often offer built-in analytics dashboards or API integrations to tie results directly into your broader business intelligence systems.

5. Prioritize Integration and Compatibility

Your chosen AI accounting tool should be able to seamlessly integrate with existing ERP, billing, payroll, and CRM systems. Poor integration leads to data silos that reduce the capability and value of AI tools.

To ensure integration success:

- Map current workflows and identify where the AI tool fits in or replaces manual steps.

- Consult IT teams early in the procurement process to verify compatibility and resolve architectural concerns.

- Use middleware or APIs to create streamlined workflows where direct integration isn’t available.

6. Regularly Reassess Use Cases

AI is evolving quickly—and so are business demands. Periodically reevaluate the tool against your goals to ensure it remains relevant. For example, you may begin with AI-assisted reconciliations but later expand to AI-powered fraud detection or tax optimization.

Conduct quarterly or biannual reviews using this checklist:

- Are usage levels growing or declining?

- What new features or use cases have emerged since implementation?

- Are there areas where manual work can further be replaced?

7. Invest in Change Management and Training

Failing to train teams properly is one of the most common reasons AI deployments fail to deliver full ROI. Success requires a strong change management process that includes:

- Stakeholder engagement – Gain early buy-in across departments who rely on the new AI tool.

- Staff education – Offer live and recorded training, documentation, and FAQs to help users ramp up quickly.

- Champion programs – Empower power users within teams to act as internal resources and evangelists.

Employees who understand how the tool works and how it benefits them are more likely to embrace it fully, leading to higher productivity and better ROI.

8. Look Beyond Automation: Aim for Transformation

While automation is often the first goal of adopting AI in accounting, true ROI comes from utilizing AI to transform financial operations. This could involve predictive analytics for budget forecasts, intelligent anomaly detection in audits, or AI-supported strategic planning.

Ask yourself:

- How has AI changed the role of finance professionals in your business?

- Are new capabilities enabling services or value-add that weren’t previously possible?

- Is your firm moving up the value chain with AI tools?

The most successful accounting departments don’t just do the same tasks faster—they redefine what’s possible with the help of AI.

Conclusion

Measuring ROI for AI tools in accounting goes far beyond simple cost comparisons. It involves tracking performance through clearly defined KPIs, recognizing both financial and strategic outcomes, and continuously optimizing as technology and business needs change. By approaching AI adoption with a detailed plan and a long-term vision, firms can drive not only efficiency but also innovation in how accounting adds value to the organization.

Ultimately, the return you achieve is proportional to the planning and commitment you invest upfront. Choose the right tool, monitor effectively, and stay agile to capture the full scope of benefits that AI brings to accounting.